The Quantlogic Edge Speedo represents a significant advancement in the field of US equities visualization and analysis. This next-generation platform transcends the limitations of traditional chart-based analysis, offering a more intuitive and comprehensive view of market dynamics. Here are some of its key features:

The vast universe of financial markets is a complex web of ever-evolving patterns. These patterns, spanning across multiple time frames, can be the key to unlocking unparalleled insights, yet they remain elusive to many analysts relying on traditional tools. Nicholas Scarr, with his team, recognized this challenge early on during their extensive research under the Amadeus project.

It became evident that the market's dynamic nature, much like a chameleon, required a more robust and nuanced approach to decode its subtleties. The linear and static nature of traditional charts often fell short in capturing the multi-faceted dimensions of these market patterns.

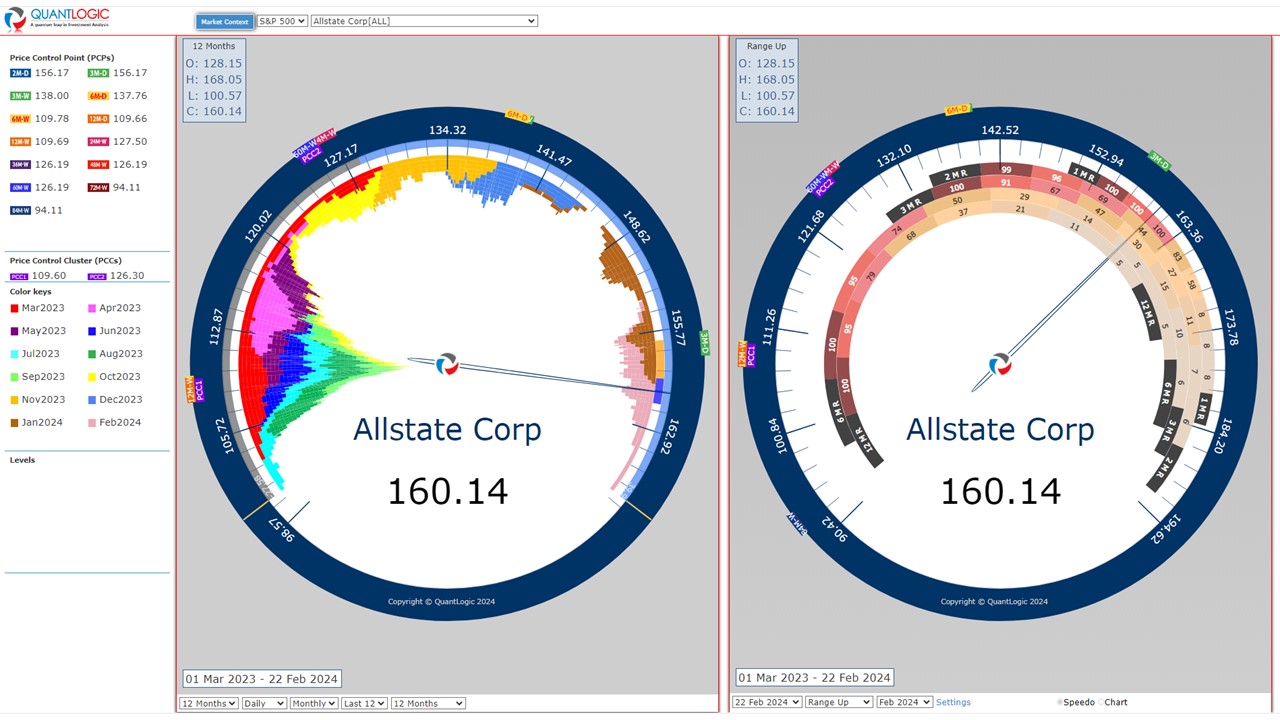

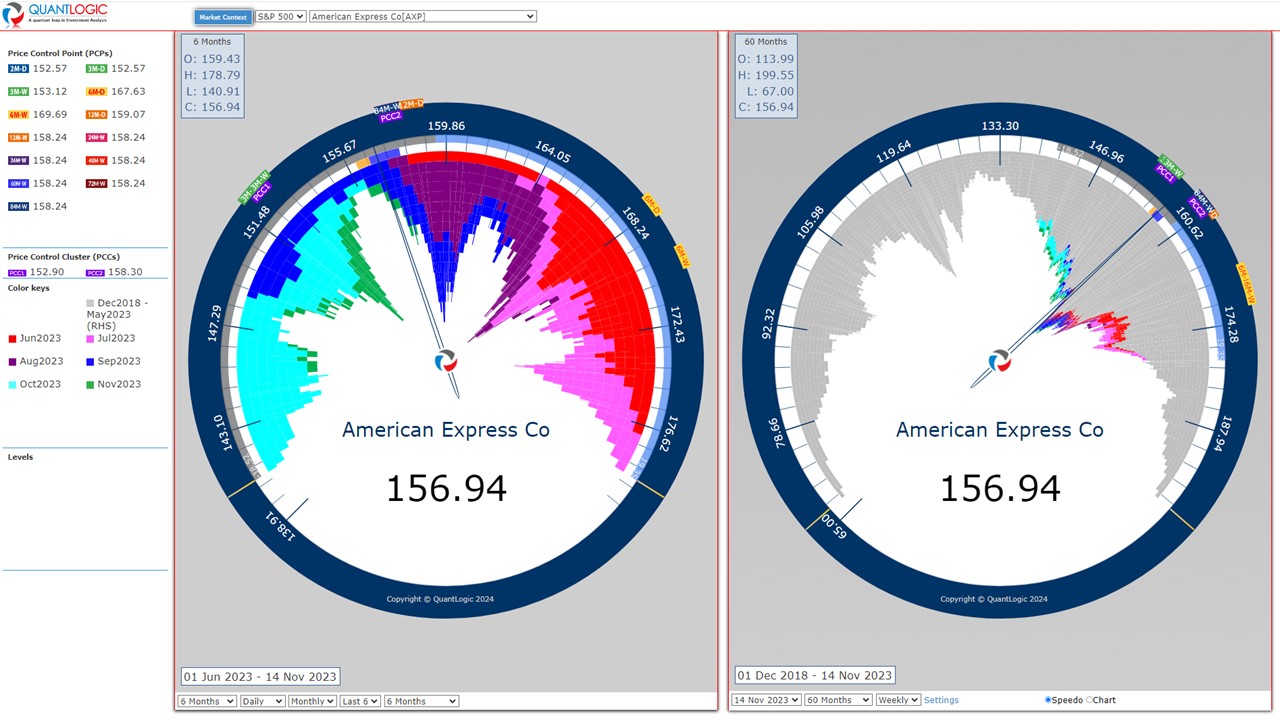

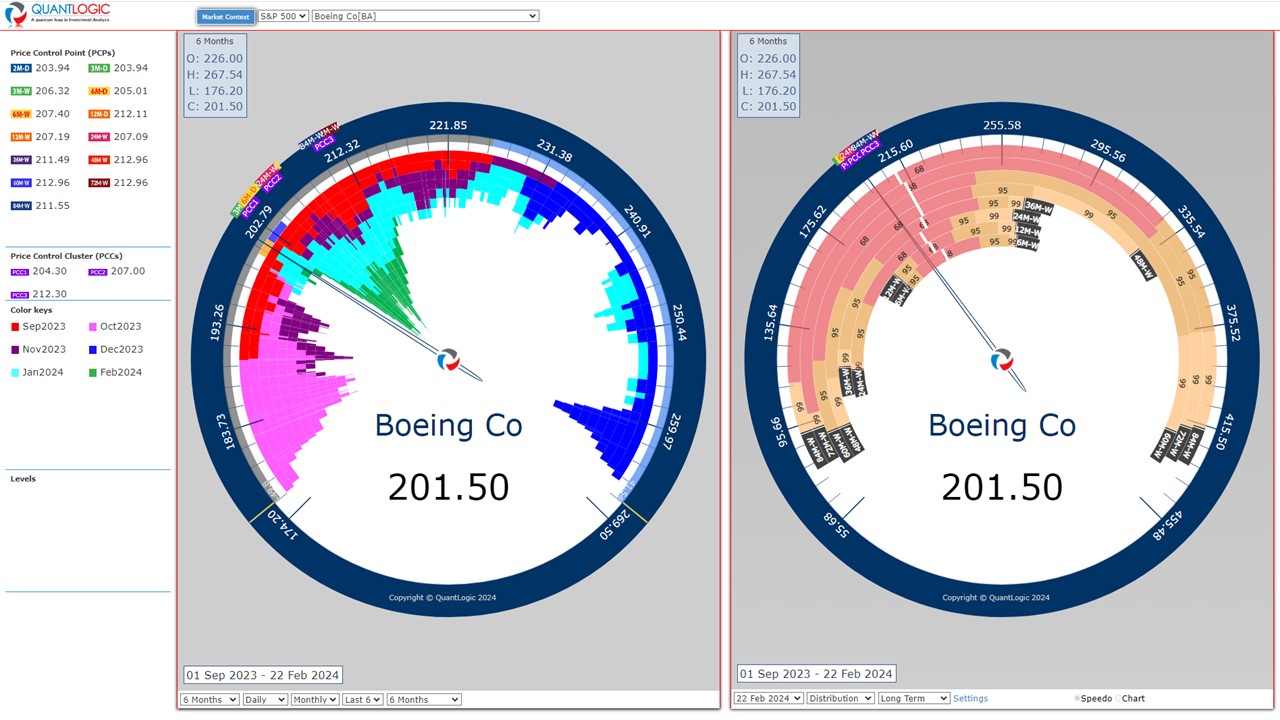

What sets Quantlogic Edge apart is its pioneering approach to visualizing these patterns. By analyzing data through multiple time frames and then representing it within the prism of a speedometer-like interface, Quantlogic Edge provides a vivid, real-time snapshot of the market's pulse. This innovative design cuts through the noise, offering clarity that was previously unattainable.

No longer are investors and traders restricted by the two-dimensional limitations of charts. With Quantlogic Edge, they can now see the market's shifting sands in a clear, concise, and comprehensible manner. This holistic view empowers users to anticipate market moves with greater confidence, ensuring they're always one step ahead.

In essence, Quantlogic Edge is not just a platform; it's a paradigm shift in market visualization. By bringing the intricate dance of market patterns into sharp focus, it is redefining the way we understand and engage with the financial landscape.

Fundamental analysis, at its core, revolves around the examination of financial statements, industry trends, and broader economic factors to determine the intrinsic value of a security. While it provides a solid foundation, the financial markets behavior isn't governed by fundamentals alone. There's a layer of market psychology, driven by the interactions of buyers and sellers, that can significantly impact the price movements in the short to medium term.

In essence, while fundamental analysis provides a strong backbone for investment decisions, Quantlogic brings in the finesse of understanding the market's pulse. In a competitive landscape, the blend of both can offer a distinctive edge, ensuring that fund managers are equipped with a 360-degree view of the market, poised to capitalize on every opportunity.